|

| Feature |

| Implementation Of Gst And Its Benefits |

| As we understand and very well have been made aware of ; that the nation is undergoing a quintessential tax reform enacted this month on 1st of July, which is anticipated to revolutionize the rules of tax system, |

| |

| Tax System India; Before and After GST |

| The very first attraction towards implementation of GST was, that it will replace 15 Indirect taxes. And to one’s amazement and wonder 15 taxes did seem a lot of chaos and confusion. |

|

|

|

| Impact Of Gst On Key Industries |

| After one of the biggest tax reforms of the nation and all the hullabaloo as to its long term and short term results, the anxiousness of such a change is palpable in the country throughout...[ Read more ] |

| Up Close and Personal |

From the desk of Industries leading experts, bringing you some unique insights on the evolution of the tax regime. Get to know how GST can impact the employer-employee relationship, and whether the taxation policies will prove to be an unending storm or a sign of soothing favorable winds.

Sunil Gupta

Founder and Director of ExportersIndia.com

The Gross Impact of GST on Indian SMEs

|

|

Ruma Mukherjee Batheja

HR Head

Knowledgetics

How will GST impact employee-employer transactions?

|

|

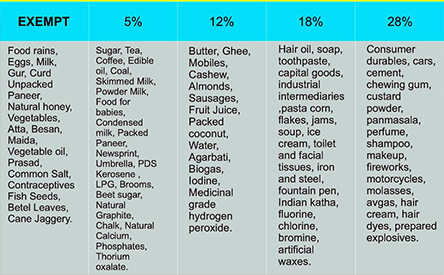

| GST Rates of all items and goods in India. |

|

| |

|

| |

|

| |

|

|

|

|

|

| Issue 4 - Volume 7 | July 2017 |

|

A Message from the Founder

| |

|

|

|

|

A change, a transition always demands perseverance and patience, any revolutionary endeavor calls for a sense of responsibility. I welcome you all to this month’s Newsletter with keeping these words in great importance. |

Our organization SMBConnect has always worked to put the best foot forward in order to facilitate the growth of the business sector. It is with this conviction and motto we decide the theme for every segment and our team works to bring you the latest and the best resources.

With a major transition in country’s taxation system; implementation of GST has created a sense of anxiety and uncertainty in all the sectors of the country. Various questions and doubts still stand unanswered, and so we are here with all the latest GST updates, FAQs and benefits pertaining to each sector to help achieve a layer of clarity and a sense of ease.

Sharing how SMBConnect stands GST ready, our very first step was to ensure the best training for our finance team and upgrade our accounting/financial software accordingly. Businesses need to be GST compliant, there is no other way around it at this hour. The only advice I can provide is to make the best of the opportunity, at a time when the questions are rampant and criticism at the peak, be the one to look above it and get your documentations and processes ready as per the terms. Will again want to take your attention to my starting note “any revolutionary endeavor calls for sense of responsibility”.

Amidst these myriad of changes, we stand even stronger and with great pride would like to announce that, SMBConnect is now partner with Digital India for upcoming flagship event – START.MANAGE.EXPAND Season 4.

Once again, we are immensely appreciative of your significant feedbacks each month. Keeping the positive practice intact, your valuable comments are most welcome on info@smbconnect.in

Best Wishes,

Sandipan Ray

Director, SMBConnect |

| |

| |

|

|

| |

|

| » |

If someone trades only 0% GST items (grains, pulses) then is it necessary to register for GST, even if the turnover exceeds 20 lakhs?

A person dealing with 100% exempted supply is not liable to register irrespective of turnover. |

| » |

If there are two SEZ units within same state, whether two registrations are required to be obtained?

SEZs under same PAN in a state require one registration. |

| » |

If a company in State1 holds only one event in State2, will they have to register in State 2? Will paying IGST from Sate1 suffice?

Only if you provide any supply from Sate2 you will need to take registration in State2. Else, registration at Sate1 is sufficient (and pay IGST on supplies made from State1 to State2) |

| » |

What is composition scheme under GST?

The composition scheme allows qualifying taxpayers — those whose turnover in the preceding financial year was less than 50 lakhs — to pay a percentage of their yearly turnover in a state as tax. This relieves the taxpayers from collecting tax from their customers directly and provides other benefits as well. |

| » |

In case of service supplied, should the credit be given to the state where it is billed or the state it is rendered?

Tax will be collected in the State from which the supply is made. The supplier will collect IGST and the recipient will take IGST credit. |

| » |

Till what time is transition credit available?

The window to declare transition credit forms is three months from the appointed day. |

| » |

Which are the mode of payments through which dealer can pay their tax?

A Three modes of payment through which dealers can pay their tax are as follows:

a) Payment by taxpayers through Internet Banking (Retail Internet Banking and Corporate internet Banking) through authorized banks.

b) Payment by taxpayers through credit card/debit card;

c) Over the Counter payment (OTC) through authorized banks; (available for payments up to

Rs.10, 000/- per challan only.) d) Payment through NEFT/RTGS.

|

| » |

Will B2B transactions be subject to GST?

Yes, all procurement will be subject to GST but businesses will get a credit for B2B transactions. Please note that GST will have to be paid before a credit is received. |

| » |

Are promotional items and/or free samples subject to GST?

Yes, the stock transfer of promotion materials and/or free samples will be subject to GST, and supply of those promotion materials/free samples to the retailers who stock your product, or end customers, will also be subject to GST. |

| » |

What is input credit? How to claim input credit under GST?

Input credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. Input Credit Mechanism is available to you when you are covered under the GST Act.

To claim input credit under GST –

1. You must have a tax invoice (of purchase) or debit note issued by registered dealer.

2. You should have received the goods/services

3. The tax charged on your purchases has been deposited/paid to the government by the supplier in cash or via claiming input credit.

4. And the supplier must have filed GST returns. |

|

|

|

|